Staples: King Of Office Supplies

Staples (SPLS) dominates the office supply store space: there is no reason to think it won't one day push its principle competitors to the curb. But the shares languish despite the strength of the business and healthy (and steady) cash flow. A speculator might not be able to get a "pop" out of this one, but patient investors take note: Staples might hold its dominate position in the future--a long profitable future. The share price does not reflect the safety of the returns (which would find its mathematical expression in a lower discount rate used). This "pick" is as much about safety of principle as much as it is about the adequacy of return.

North American Retail

We are all familiar with the "easy button" ads and with their retail outlets, but that represents less than half of Staples' operating income. In 2011, consumer facing retail made up 38% of Staples revenue, 45% if its operating income and a similar amount of its capital expenditures. It is making moves into electronics retailing by moving products to the front of store (among other design changes) and reemphasizing electronics generally. For instance, in the May Q1 2012 conference call, CEO Ron Sargent said:

During the first quarter, sales of mobile phones and accessories nearly doubled, and we achieved strong double-digit top line growth in new technology products like tablets and eReaders.

This corroborates with plans stated in Sargent's letter to shareholders written in April 2012:

Over the past two years we've remodeled the technology area in more than half off our stores to improve how we sell and service technology products. This helped to drive strong sales growth in categories like tablets and e-readers, as well as our EasyTech business during 2011. We also made a big push into the mobile phone business to address an essential need off small business customers, and we now have a mobile department in 500 stores across the United States.

Staples makes a little less than half of its money from retail where it dominates the competition. In North America, for example, Office Max (OMX) has 978 stores with average revenue per store of $3.5 million, Office Depot (ODP) has 1,131 stores with average revenue of $4.3 million per store, and Staples has 1,900 stores with an average of $5.08 million per store--or it has about 67% more stores, which make 18% more on average compared with their nearest competitor. Even while its retail is a success (historically speaking), the majority of its revenue and income is from its North American Delivery segment.

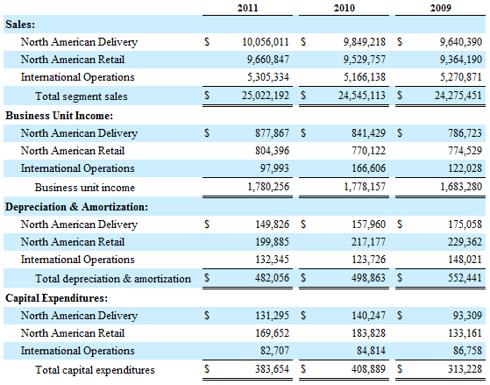

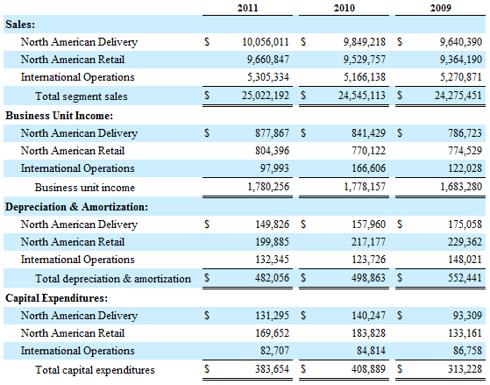

First, some segment Information (Staples 2011 10-K, page C-33; in thousands):

Notice above the low "business unit income" from "international operations" compared with its proportion of revenue. Management is looking to turn around the overseas segment and have reduced headcount by about 300 positions in an effort to improve profitability. We will see that Staples can still be considered undervalued even while ignoring future growth outside North America.

North American Delivery

The majority of North American Delivery customers place their orders online, making Staples the 2nd-largest online retailer in the world, after Amazon (AMZN) (See Staples 2011 10-K, page 1; for further evidence, see rankings here). Given the overall depressive effect the success of Amazon is having on brick-and-mortar retail, if such an effect is present in the shares of Staples--it is unjustified.

Of Staples revenue, 27% was from proprietary brands which both (i) sell for cheaper than national brands and (ii) provide a higher gross margin. Staples would like to push that figure up to 30% (2011 10-K, p. 3).

Part of Staples' plan to continue to grow is to move out from core office supply categories, into "adjacent" categories, such as "facilities and breakroom supplies." As of Q1 2012, these new categories had increased by 20% year over year. To further expand from core categories, Ron Sargent noted that Staples is "building on our success in facilities and breakroom supplies with an expanded assortment of safety and industrial supplies" (Q1 2012 Conference Call Transcript).

The Downside Is Limited

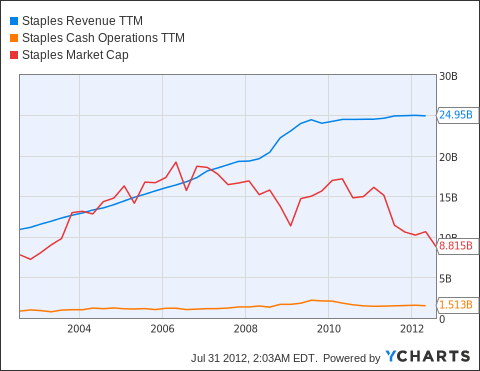

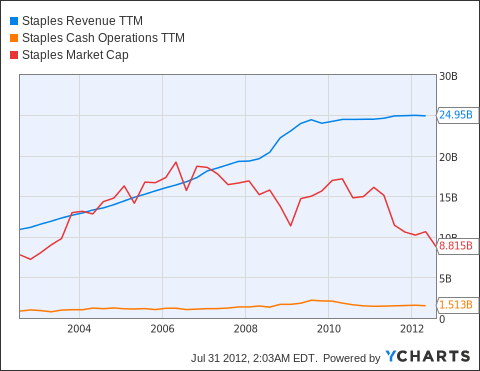

Since January 2011, Staples has decreased its debt by 22%. Throughout the same period, shares outstanding have decreased 4.3%. One can see from the chart above that while revenue growth has slowed, Staples' market capitalization has fallen precipitously. Further, Staples is registering its lowest price-to-sales ratio ever.

Staples' primary business is delivering necessary office supplies to businesses. Business purchases tend to be more consistent and less fickle than consumer purchases. They build long-term relationships and large contract customers come to rely on their supplier, i.e., Staples. Staples' business customers are unlikely to give up shopping at Staples in the near future. Further, competitors hold weak and falling market positions. It could turn out that the office supply space is like the electronics retail space and we will see Staples' principle competitors fade away like Circuit City.

Valuation

With 2011 free-cash-flow at around $1,050 million (and growing moderately), the price to free-cash-flow ratio is:

Market Capitalization / Free-Cash-Flow = P/FCF

$8,780 million / $1,050 million = 8.36

On a trailing twelve month basis, it has a higher free-cash-flow yield than 85% of the S&P 500 (and some of those 15% are financial companies which shouldn't count since the free-cash-flow concept doesn't apply in the same way to them). With a FCF yield of almost 12%, possible long-term growth prospects and a dominate market position, Staples looks like a good long-term retail holding.

Another author on this site mentioned that Staples needs a "catalyst" for growth. While I think revenue growth will be probably not be much above GDP in the near term, there is also no near-term catalyst, which might result in a change of opinion about the shares. While the shares present a good long-term holding, they may continue to languish while people ignore the strength of the business. There is no "phase-change" or transition-catalyst in sight to call investors to rethink their valuations of Staples. Therefore, for those looking for quick capital appreciation, Staples might not be the stock for you. But downside is limited, and the return of the shares (overtime and barring any unforeseen cataclysm) will very likely exceed the returns offered by other companies.

Boring companies don't get much love, but boring companies frequently offer safe and satisfactory long-term returns.

http://seekingalpha.com/article/764961- ... urce=yahoo