เอาศัพท์มาฝากครับ Letter of credit คืออะไร !!!

โพสต์แล้ว: อังคาร เม.ย. 08, 2008 2:07 pm

ครึ้มอกครึ้มใจ

ได้ยินมานานแล้วครับ กับคำๆนี้

เลยเอาศัพท์มาฝาก แต่เสียอยู่เรื่องเดียวครับ

แปลไม่ค่อยคล่องครับ

ท่านผู้รู้ วาน อ่านแล้วแปลต่อ

จักเป็นวิทยานุทาน ต่อเพื่อน ๆด้วยค้าบบบ

Letter of credit

From Wikipedia, the free encyclopedia

Jump to: navigation, search

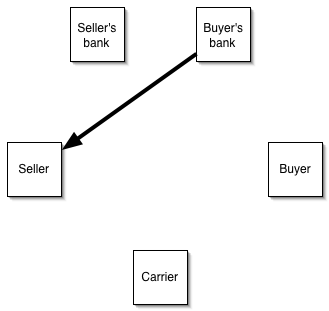

After a contract is concluded between buyer and seller, buyer's bank supplies a letter of credit to seller.

After a contract is concluded between buyer and seller, buyer's bank supplies a letter of credit to seller.

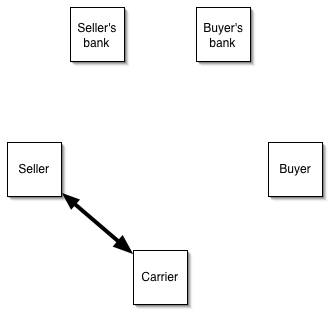

Seller consigns the goods to a carrier in exchange for a bill of lading.

Seller consigns the goods to a carrier in exchange for a bill of lading.

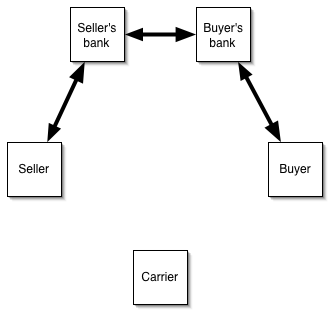

Seller provides bill of lading to bank in exchange for payment.

Seller's bank exchanges bill of lading for payment from buyer's bank.

Buyer's bank exchanges bill of lading for payment from buyer.

Seller provides bill of lading to bank in exchange for payment.

Seller's bank exchanges bill of lading for payment from buyer's bank.

Buyer's bank exchanges bill of lading for payment from buyer.

Buyer provides bill of lading to carrier and takes delivery of goods.

Buyer provides bill of lading to carrier and takes delivery of goods.

A letter of credit is a document issued mostly by a financial institution which usually provides an irrevocable payment undertaking

(it can also be revocable, confirmed, unconfirmed, transferable or others e.g. back to back: revolving but is most commonly irrevocable/confirmed) to a beneficiary against complying documents as stated in the Letter of Credit.

Letter of Credit is abbreviated as an LC or L/C, and often is referred to as a documentary credit, abbreviated as DC or D/C, documentary letter of credit, or simply as credit (as in the UCP 500 and UCP 600).

Once the beneficiary or a presenting bank acting on its behalf, makes a presentation to the issuing bank or confirming bank, if any, within the expiry date of the LC, comprising documents complying with the terms and conditions of the LC, the applicable UCP and international standard banking practice, the issuing bank or confirming bank, if any, is obliged to honour irrespective of any instructions from the applicant to the contrary.

In other words, the obligation to honour (usually payment) is shifted from the applicant to the issuing bank or confirming bank, if any. Non-banks can also issue letters of credit however parties must balance potential risks.

The LC can also be the source of payment for a transaction, meaning that an exporter will get paid by redeeming the letter of credit.

Letters of credit are used nowadays primarily in international trade transactions of significant value, for deals between a supplier in one country and a wholesale customer in another.

They are also used in the land development process to ensure that approved public facilities (streets, sidewalks, stormwater ponds, etc.) will be built. The parties to a letter of credit are usually a beneficiary who is to receive the money, the issuing bank of whom the applicant is a client, and the advising bank of whom the beneficiary is a client. Almost all letters of credit are irrevocable, i.e., cannot be amended or canceled without prior agreement of the beneficiary, the issuing bank and the confirming bank, if any. In executing a transaction, letters of credit incorporate functions common to giros and Traveler's cheques. Typically, the documents a beneficiary has to present in order to avail himself of the credit, are commercial invoice, bill of lading, insurance documents. However, the list and form of documents is open to imagination and negotiation and might contain requirements to present documents issued by a neutral third party evidencing the quality of the goods shipped.

ได้ยินมานานแล้วครับ กับคำๆนี้

เลยเอาศัพท์มาฝาก แต่เสียอยู่เรื่องเดียวครับ

แปลไม่ค่อยคล่องครับ

ท่านผู้รู้ วาน อ่านแล้วแปลต่อ

จักเป็นวิทยานุทาน ต่อเพื่อน ๆด้วยค้าบบบ

Letter of credit

From Wikipedia, the free encyclopedia

Jump to: navigation, search

After a contract is concluded between buyer and seller, buyer's bank supplies a letter of credit to seller.

After a contract is concluded between buyer and seller, buyer's bank supplies a letter of credit to seller.

Seller consigns the goods to a carrier in exchange for a bill of lading.

Seller consigns the goods to a carrier in exchange for a bill of lading.

Seller provides bill of lading to bank in exchange for payment.

Seller's bank exchanges bill of lading for payment from buyer's bank.

Buyer's bank exchanges bill of lading for payment from buyer.

Seller provides bill of lading to bank in exchange for payment.

Seller's bank exchanges bill of lading for payment from buyer's bank.

Buyer's bank exchanges bill of lading for payment from buyer.

Buyer provides bill of lading to carrier and takes delivery of goods.

Buyer provides bill of lading to carrier and takes delivery of goods.

A letter of credit is a document issued mostly by a financial institution which usually provides an irrevocable payment undertaking

(it can also be revocable, confirmed, unconfirmed, transferable or others e.g. back to back: revolving but is most commonly irrevocable/confirmed) to a beneficiary against complying documents as stated in the Letter of Credit.

Letter of Credit is abbreviated as an LC or L/C, and often is referred to as a documentary credit, abbreviated as DC or D/C, documentary letter of credit, or simply as credit (as in the UCP 500 and UCP 600).

Once the beneficiary or a presenting bank acting on its behalf, makes a presentation to the issuing bank or confirming bank, if any, within the expiry date of the LC, comprising documents complying with the terms and conditions of the LC, the applicable UCP and international standard banking practice, the issuing bank or confirming bank, if any, is obliged to honour irrespective of any instructions from the applicant to the contrary.

In other words, the obligation to honour (usually payment) is shifted from the applicant to the issuing bank or confirming bank, if any. Non-banks can also issue letters of credit however parties must balance potential risks.

The LC can also be the source of payment for a transaction, meaning that an exporter will get paid by redeeming the letter of credit.

Letters of credit are used nowadays primarily in international trade transactions of significant value, for deals between a supplier in one country and a wholesale customer in another.

They are also used in the land development process to ensure that approved public facilities (streets, sidewalks, stormwater ponds, etc.) will be built. The parties to a letter of credit are usually a beneficiary who is to receive the money, the issuing bank of whom the applicant is a client, and the advising bank of whom the beneficiary is a client. Almost all letters of credit are irrevocable, i.e., cannot be amended or canceled without prior agreement of the beneficiary, the issuing bank and the confirming bank, if any. In executing a transaction, letters of credit incorporate functions common to giros and Traveler's cheques. Typically, the documents a beneficiary has to present in order to avail himself of the credit, are commercial invoice, bill of lading, insurance documents. However, the list and form of documents is open to imagination and negotiation and might contain requirements to present documents issued by a neutral third party evidencing the quality of the goods shipped.